We generate and qualify listing leads for you.

We're here to assist you in generating and converting listing leads through the magic of A.I. From click to close, we are your marketing team and ISA at a fraction of the cost.

We're here to assist you in generating and converting listing leads through the magic of A.I. From click to close, we are your marketing team and ISA at a fraction of the cost.

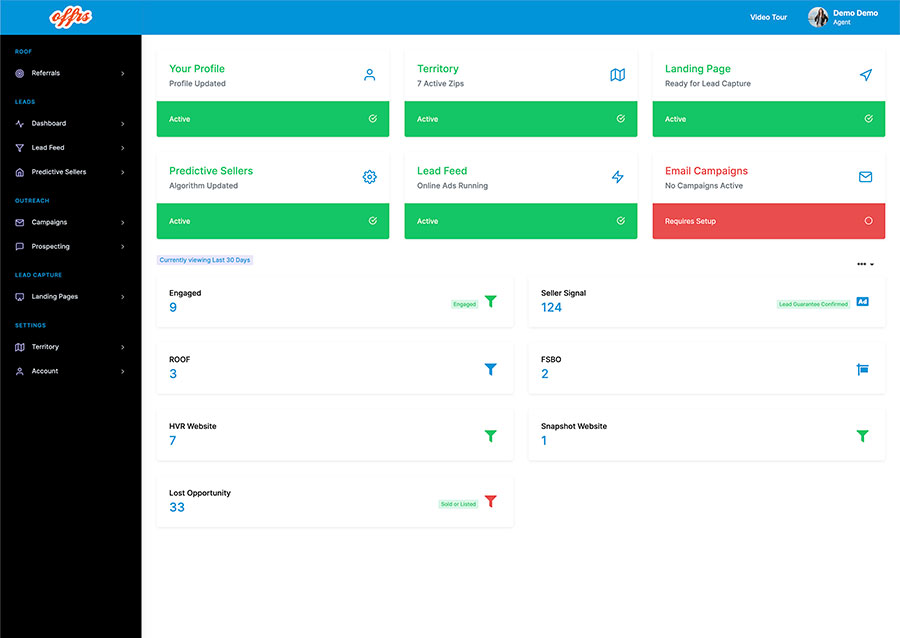

Predictive Analytics and Big Data drive most decisions in businesses around the world. Now it can be used to grow your Real Estate business.

We guarantee 30 leads per month with our new Lead Feed product. If we fall short, we will automatically expand your area at no additional cost.

Sign up

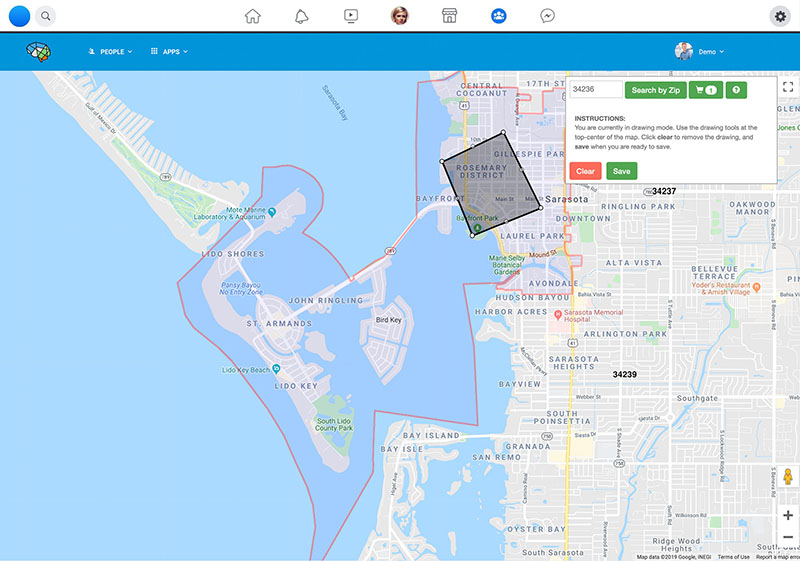

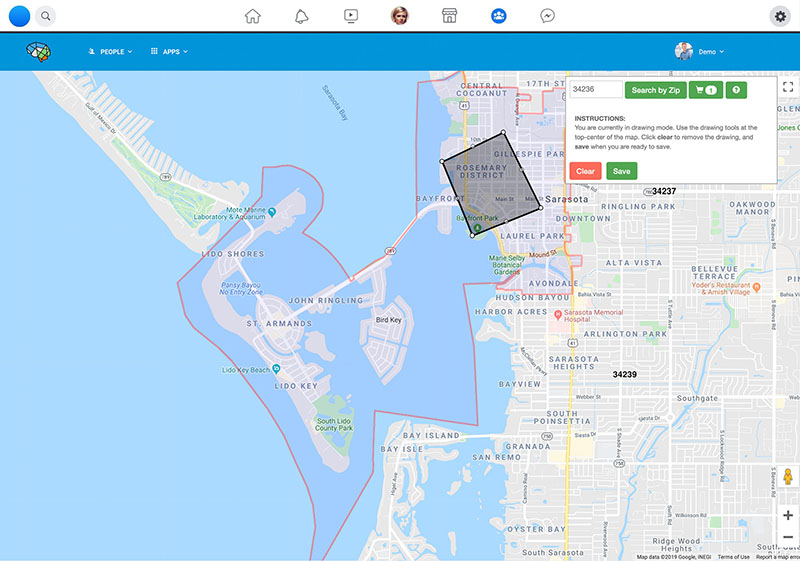

You can access our Smart Data anywhere. Simply search by zipcode and you can access contact information for all homeowners and more importantly our leads.

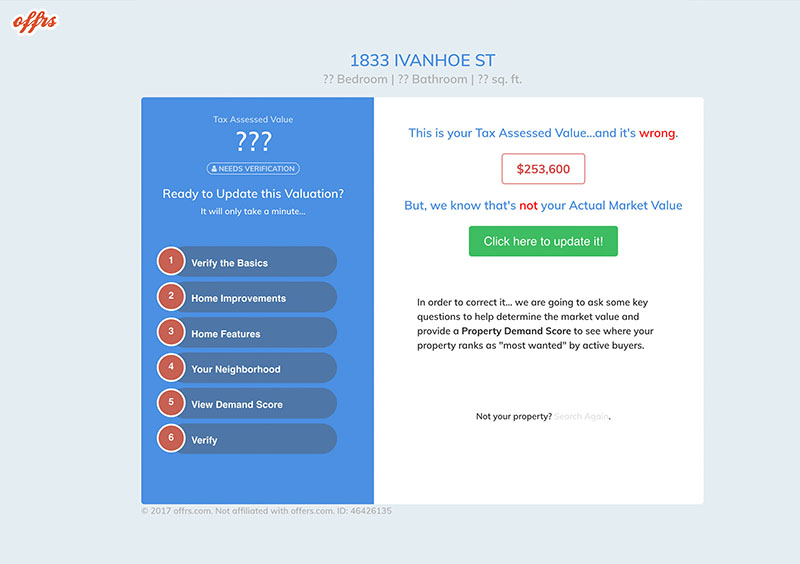

We generate leads leveraging our proven online advertising and through a multitude of date providers from popular real estate websites.

Our lead capture ads and landing pages have been refined over time to ensure we generate quality leads for our customers.

Our Predictive Sellers saves you time and money by focusing on who is most likely to list their home.

Discover the power of artificial intelligence (AI) in revolutionizing real estate lead capture. Learn how AI optimizes geographical farming and turns data into actionable insights for efficient seller lead capture using platforms like offrs.com.

Read StoryUncover the secret to effective listing and seller lead generation using AI. From geographical farming to lead optimization, discover how AI enhances these processes and empowers platforms like offrs.com.

Read StoryDiscover how AI is transforming the traditional approaches of gathering real estate leads. From optimizing geographical farming to practical guides leveraging platforms like offrs.com, delve into an AI-powered revolution.

Read StoryUnveil AI's paramount role in advanced real estate strategies, lead generation to geographical targeting. Learn how AI platforms enhance branding and increase acquisition, providing essential insights for savvy real estate agents.

Read StoryDiscover how artificial intelligence can supercharge lead generation strategies in real estate. Learn how to use AI tools for geographical farming to gain a competitive edge and achieve market excellence.

Read StoryUnearth how Artificial Intelligence and predictive analytics tools can help real estate agents tap into fresh markets and maximize their market share.

Read StoryUncover how AI-driven lead generation fuels recruitment and agent retention in Real Estate. Explore the transformational role of AI in predicting hot markets and identifying potential agents.

Read StoryExplore the transformative potential of AI for real estate listings and yield higher quality leads. Future-proof your strategies and outsmart the competition.

Read StoryDiscover how AI is transforming the Real Estate industry by enhancing lead conversions, tailoring according to consumer behaviors, and boosting customer relations.

Read StoryUnearth the innovative role of AI in revolutionizing real estate marketing, from automatic content generation to personalized marketing strategies.

Read StoryDiscover how AI technology is revolutionizing the real estate sector's closing process by providing automation, detecting anomalies, ensuring compliance, and fortifying security.

Read StoryExplore how Artificial Intelligence (AI) is revolutionizing the real estate sector by automating contract analysis, minimizing risks, and ensuring compliance.

Read StoryDiscover the revolutionary role of AI in real estate, providing constant customer support via innovative tools like virtual assistants and chatbots.

Read StoryThe proactive management of AI plays a critical role in the modern real estate sector. This article navigates strategies for mitigating risks of AI implementation and opportunities in leveraging AI to transform real estate practices.

Read StoryDiscover how real estate brokers can employ AI technology to automate tasks, analyze data smartly, and deliver personalized customer experiences that outshine their competitors.

Read StoryUncover the key reasons why brokers should take the forefront in incorporating AI technology within their firms, highlighting the merits of its appropriate usage, benefits realization, and staff training enhancement.

Read StoryUnearth the potential of AI assistants in the real estate sector, focusing on process automation, intelligent customer profiling, and instant decision-making abilities. Discover through various examples, how AI is amplifying efficiency and advancing client relationships.

Read StoryExplore how AI is rapidly transforming the real estate industry, driving competition and enhancing service delivery. Learn how to leverage AI's power to gain a competitive edge.

Read StoryTake a deep dive into the changing tides of real estate transactions and the need for a shift in agent compensation norms, with a focus on representing sellers more effectively.

Read StoryNavigate the shift to a seller-centric strategy in real estate for a profitable business. Explore the benefits, understand the steps, and discover how prioritizing sellers can define your success.

Read StoryThis article unravels the significance of concentrating on seller listings due to recent alterations in buyers' agent compensation. It provides valuable insight into how real estate agents can optimize their marketing to draw home sellers effectively.

Read StoryUnlock the top ten strategies that will empower real estate agents to increase property listings and reach potential clients in the ever-evolving industry dynamics.

Read StoryDiscover how Offrs.com and ROOF can revolutionize your real estate business, offering predictive analytics, efficient marketing automation, and enhanced listing acquisition.

Read StoryDiscover the transformative impact of AI on real estate listings, highlighting the power of predictive analytics, audience matching, and targeted advertising to win listings more effectively.

Read Story